extract from

our sustainability

report 2023.

All The numbers refer to 2024

We enable circular tech

Foxway’s circular business model offers many opportunities to our partners and customers. We enable circularity through services such as Device as a Service (DaaS), trade-in solutions, value recovery, and IT Asset Disposition (ITAD).

The value propositions in Foxway are based on circular management of tech devices and ensuring a second, third, and sometimes even fourth life. When the end-of-life is reached for the devices, Foxway ensures secure and sustainable recycling by extracting parts and components (urban mining) and later ensuring that waste materials are recycled for material recovery in an environmentally responsible and compliant way.

Our business model makes us one-of-a-kind in the market. Simply put, we make sure that companies maximize their digitalization while minimizing their carbon footprint. We guide our partners and customers in their transition to consume tech more sustainably by introducing circularity instead of traditional linear consumption — the Foxway is the circular way.

In Foxway we are proud to share that almost 50% of our co-workers are oriented to work tasks targeting repairs, value-add, upgrades and rescuing devices for another use. Foxway stands out as a distinctive player in the circular tech industry, providing a sustainability approach that transcends merely being an add-on to an industry largely focused on linear consumption models.

Company at a glance.

Headquartered:

Solna, Sweden

FTE:

1,327 (+18%)

Revenues:

644 EURm (+21%)

CSRD applicability:

Yes (included in the 2024 CSRD

framework as a listed company)

All topics were scored on several

dimensions from 1-5

Impact materiality scoring dimensions

Scale How grave the negative impact is or how beneficial the positive impact is

Scope How widespread the negative or positive impacts are

Irremediability Whether and to what extent negative impacts can be remediated

Scale

1. Minimal impact

2. Low impact

3. Medium impact

4. Significant impact

5. Major impact

Scope

1. Limited reaching impact e.g., affecting a limited number of individuals

2. Concentrated impact e.g., affecting some Foxway customers/supplier/employees

3. Medium reach e.g., affecting all Foxway customers/suppliers/employees

4. Widespread impact e.g., Scandinavia-wide

5. Universal impact e.g., worldwide

Irremediability

1. Relatively easy to remedy short-term

2. Possibility for reversal with short-term effort

3. Possibility for reversal with medium-term effort (time & cost)

4. Only reversible with long-term effort (time & cost)

5. Creating irreversible damage

Impact materiality scoring dimensions

Financ. imp Size of potential financial cost or benefit to Foxway

Likelihood Likelihood that a risk or opportunity materialises

Time horizon Whether the risk is expected in short (<3 years), medium (3-10 years) or long (>10 years) term

Financial impact1

1. Negligible: <1m EUR (<~0.1% revenue)

2. Low: 1-5m EUR (~0.1-1% revenue)

3. Moderate: 5-30m EUR (~1-5% revenue)

4. Substantial: 30-100m EUR (~5-15% revenue)

5. Catastrophic: >100m EUR (>~15% revenue)

Likelihood

1. Remote : Only in exceptional circumstances (<1%)

2. Low : Not expected to occur (1-10%)

3. Moderate : Could occur at some point (10-50%)

4. High : Will probably occur in most circumstances (50-80%)

5. Very high: Expected in normal circumstances (>80%)

Note: Ranges based on revenue of around 700 million EUR.

Note: scoring relates to the top risk or opportunity listed in the box

A 5x5 materiality matrix was used to

combine the multiple scores for each

Impact materiality was rated based

on an overall qualitative assessment

Step 1: What is our impact on people and/or the

environment within this sustainability topic?

Step 2: How do we score it on the dimensions of scale,scope and Irremediability?

Step 3: Based on scoring from Step 2, where does the topic fall in the 5x5 Materiality Matrix from an impact perspective?

Impact Materiality

Impact materiality will influence

placement in the right quadrants

Impact materiality was rated based

on an overall qualitative assessment

Step 1: How do the topics in the long list translate into risks and/or opportunities for the company?

Step 2: How do we score it on the dimensions of likelihood and financial impact? Over what time

horizon is it expected to materialise?

Step 3: Based on scoring from Step 2, where does the topic fall in the 5x5 materiality matrix from a financial perspective?

Impact Materiality

Impact materiality will influence

placement in the right quadrants

CSRD provides scope for the company

to define the materiality threshold.

The main findings and conclusions

were documented in a one-pager per material topic.

A one-pager has been developed

for all material topics for Foxway.

Each topic’s impact and financial

materiality is explained and justified,

providing the argumentation of why it was considered material

A four-step approach was used during workshop to evaluate and finalise topic categorisation

Workshop design

Prior to workshop

– pre-read material

D

uring workshop

– facilitated dialogue

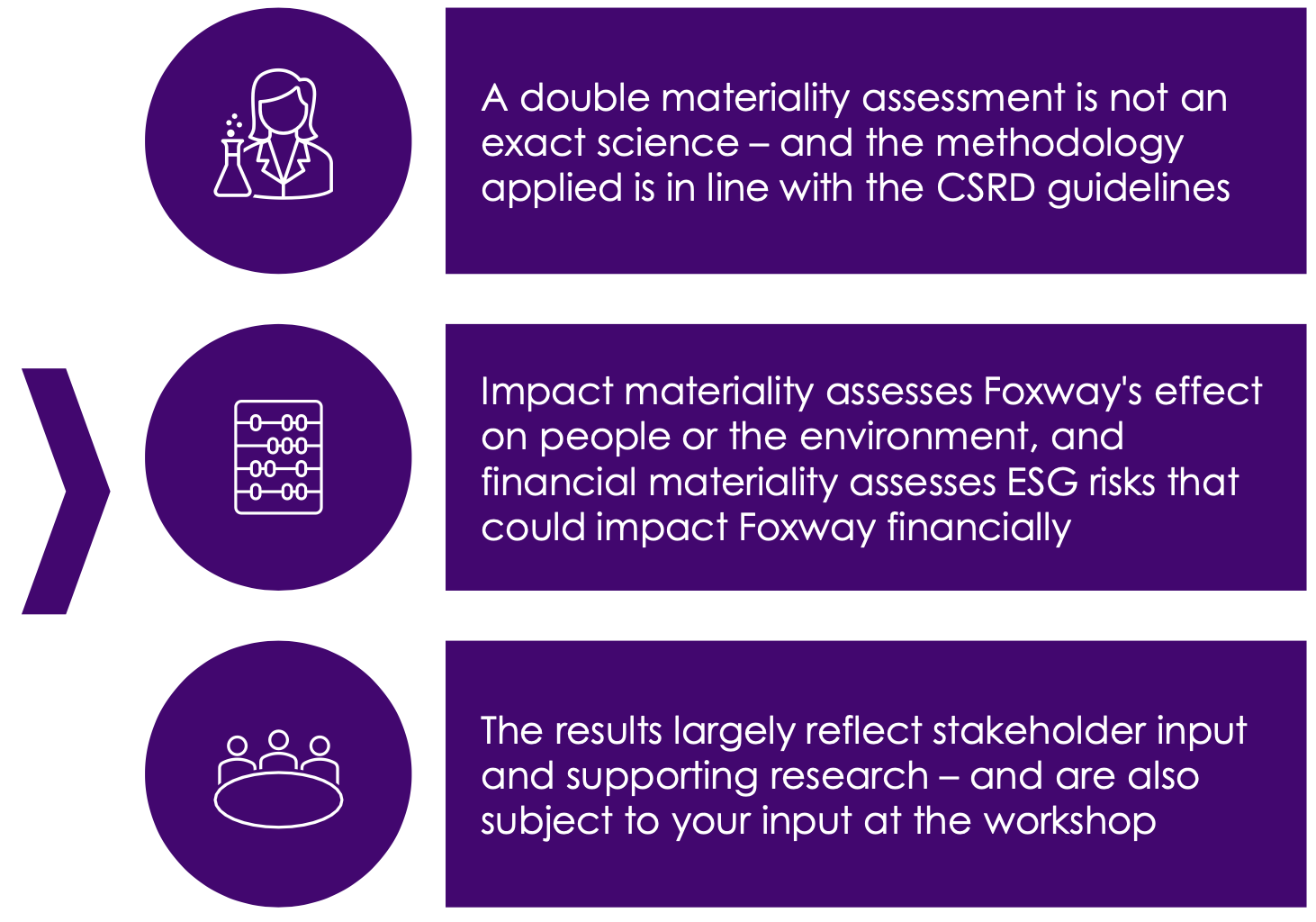

The methodology applied is

in line with CSRD requirements

Critical CSRD requirements for double materiality assessments

Engagement with stakeholders…

“Engagement with affected stakeholders is central to the undertaking’s on- going due diligence process and sustainability materiality assessment. This includes its processes to identify and assess actual and potential negative impacts, which then inform the assessment process to identify the material impacts for the purposes of sustainability reporting.”

Assessment of impact materiality…

“A sustainability matter is material from an impact perspective when it pertains to the undertaking’s material actual or potential, positive or negative impacts on people or the environment over the short-, medium- or long-term. Impacts include those connected with the undertaking’s own operations and upstream and downstream value chain, including through its products and services, as well as through its business relationships.”

Assessment of financial materiality…

“A sustainability matter is material from a financial perspective if it triggers or could reasonably be expected to trigger material financial effects on the undertaking. This is the case when a sustainability matter generates risks or opportunities that have a material influence, or could reasonably be expected to have a material influence, on the undertaking’s development, financial position, financial performance, cash cash flows, access to finance or cost of capital over the short-, medium- or long-term.”

Source: CSRD.

Key take-aways

and implications